If you’re a millennial or a zoomer, you haven’t lived in a world without card machines. If you’re a bit older,

you might call them card readers or speed points. And there’s a fair chance your grandparents call them swipe machines.

Today’s big question: how did the card machine get so many names? Let’s peer into the past.

What came first, the card or the card machine?

What came first, the card or the card machine?

If you think about it, credit cards are just IOUs. And in the 1950s, that’s exactly how it all began. A wealthy New York businessman called Frank McNamara racked up a colossal bill at his favourite restaurant. When it was time to pay, he realised that he had forgotten his wallet and left a note of credit on a piece of cardboard.

One thing led to another and the Diners Club was born. A new culture of credit payment exploded, as people began spending now but paying later.

Companies like American Express, The Bank of America (which launched the BankAmericard, made of paper), and VISA joined the party in the late 1950s. By then, the cashless revolution was truly up and running.

We have our egg. Where's the chicken?

We have our egg. Where's the chicken?

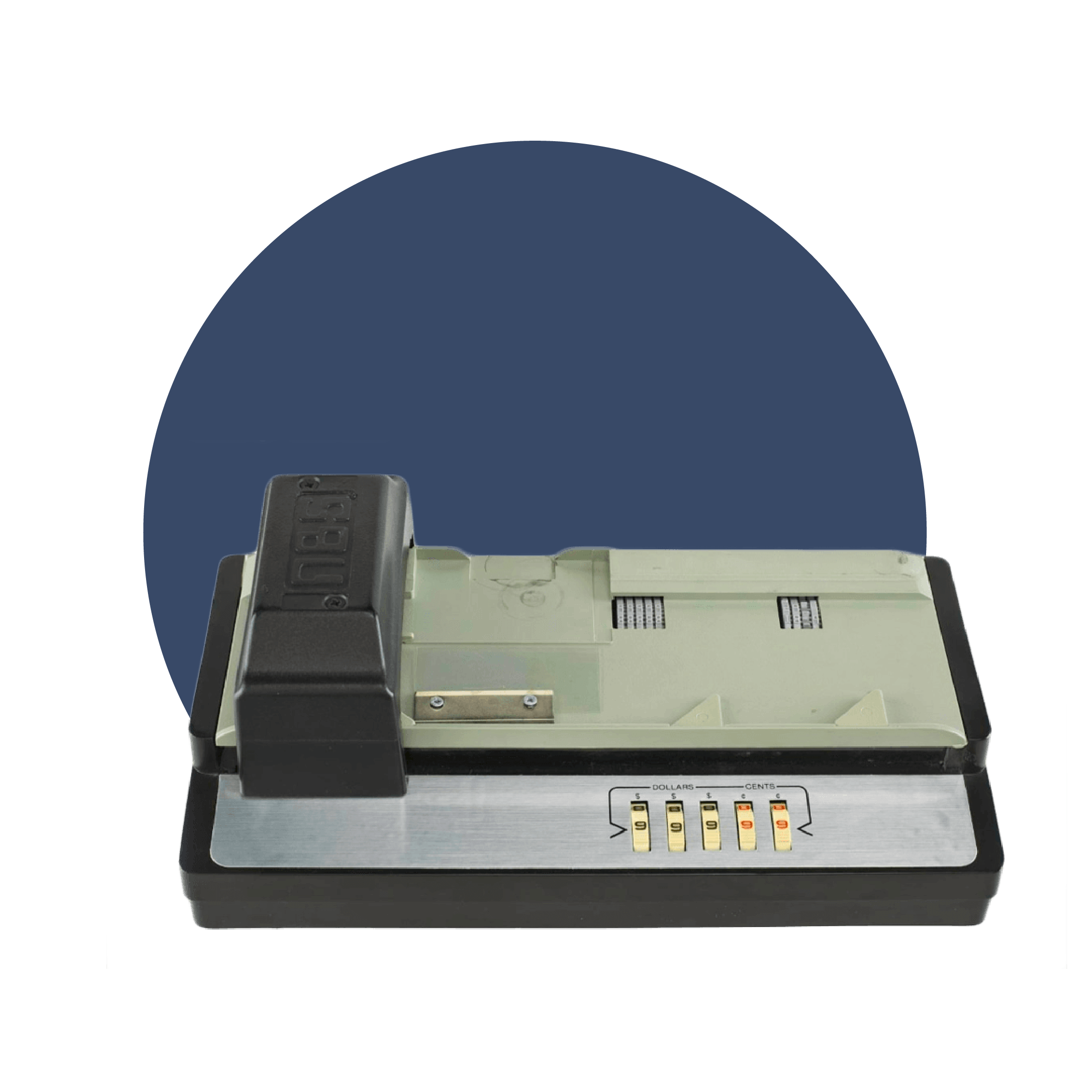

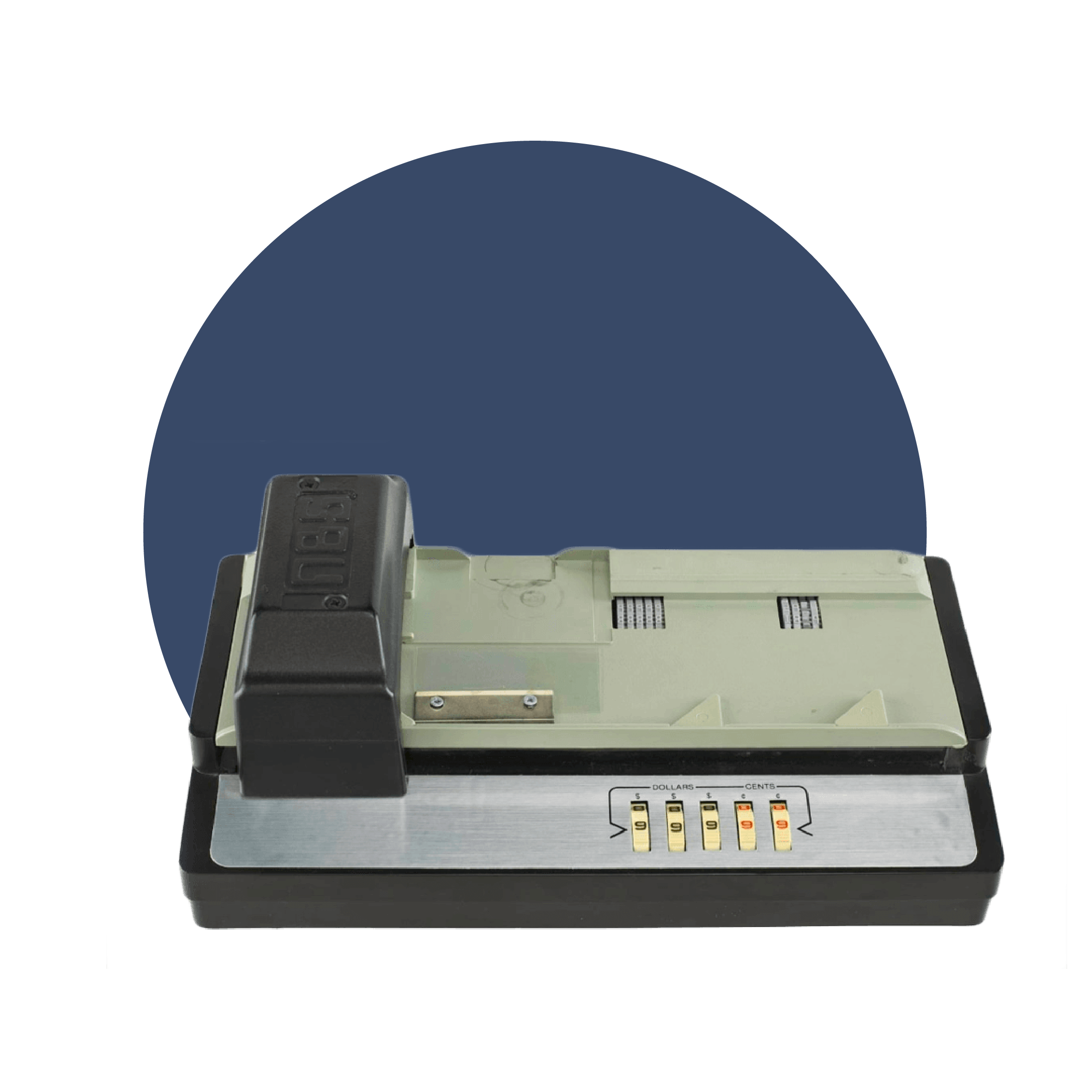

By the time the 60s came around, credit cards were everywhere. It became impractical to log every credit in ledger books, so American Express took us another step further with the first point-of-sale recorder. They called it a credit card imprinter.

Merchants would fill out a form and place it in the machine. The imprinter would run over the form and cardboard card, imprinting name and numbers on the form. The signed form would then be sent to the bank. It sounds archaic now, but you couldn’t get more cutting edge 70-odd years ago.

Analogue for who?

Analogue for who?

Two decades after paper credit cards were introduced, we took another massive step forward. In the 1970s, an IBM engineer designed a magnetic strip for cards. This magnetic strip was coded with information including the cardholder’s name, card number, authorisation code, and card expiry date. Sound familiar?

Information is only as useful as your ability to access it, so an electronic terminal was created to read these magnetic strips. Big, bulky and ugly, they saved time and catapulted payment methods into the future.

This goes a long way to explaining why people of a certain vintage might use the term ‘swipe machine’. For a while, it was the only way to read the information contained in the magnetic strip.

Let's get digital, digital....

Let's get digital, digital....

Yoco was founded on the power of small. In the early 1970s, things got small and powerful indeed.

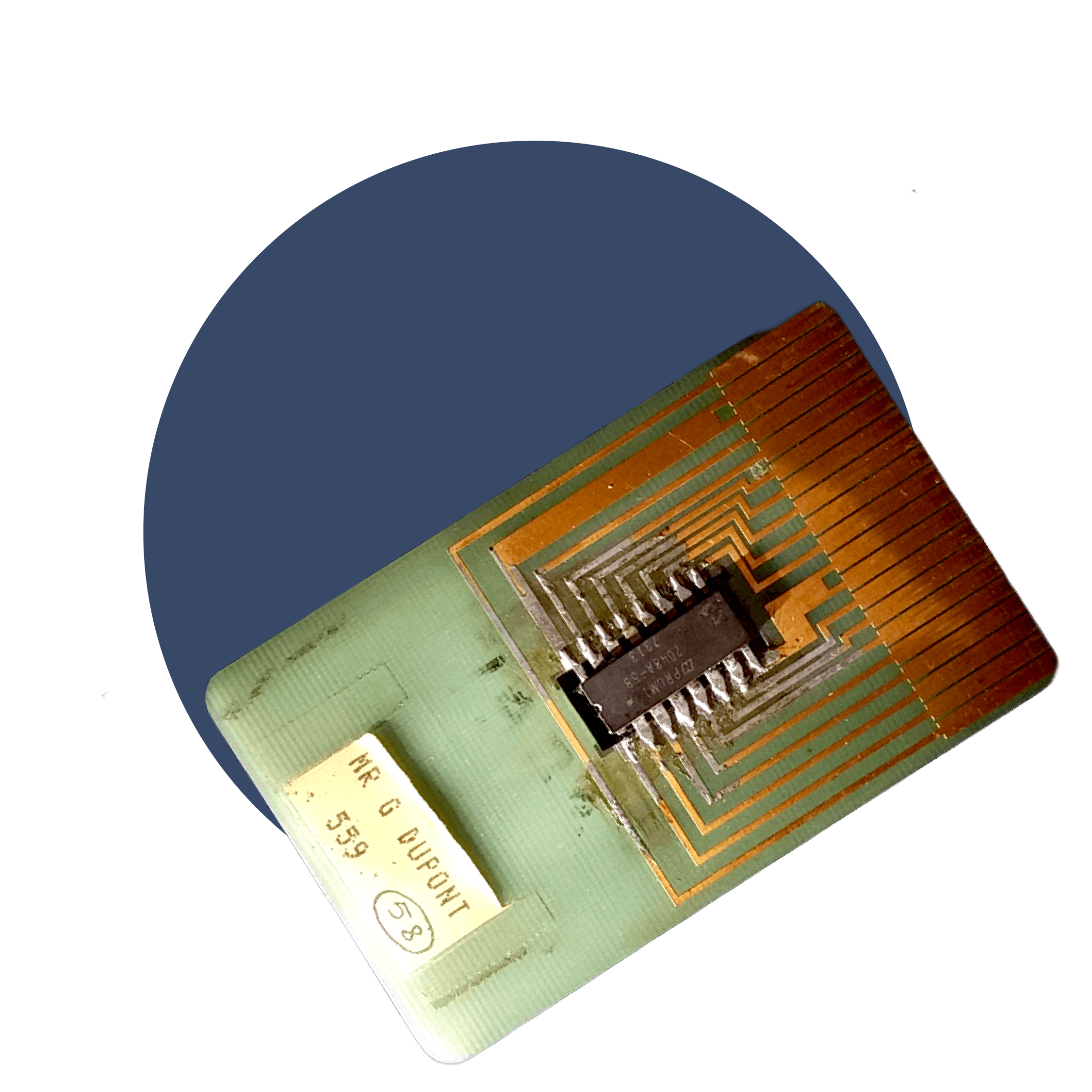

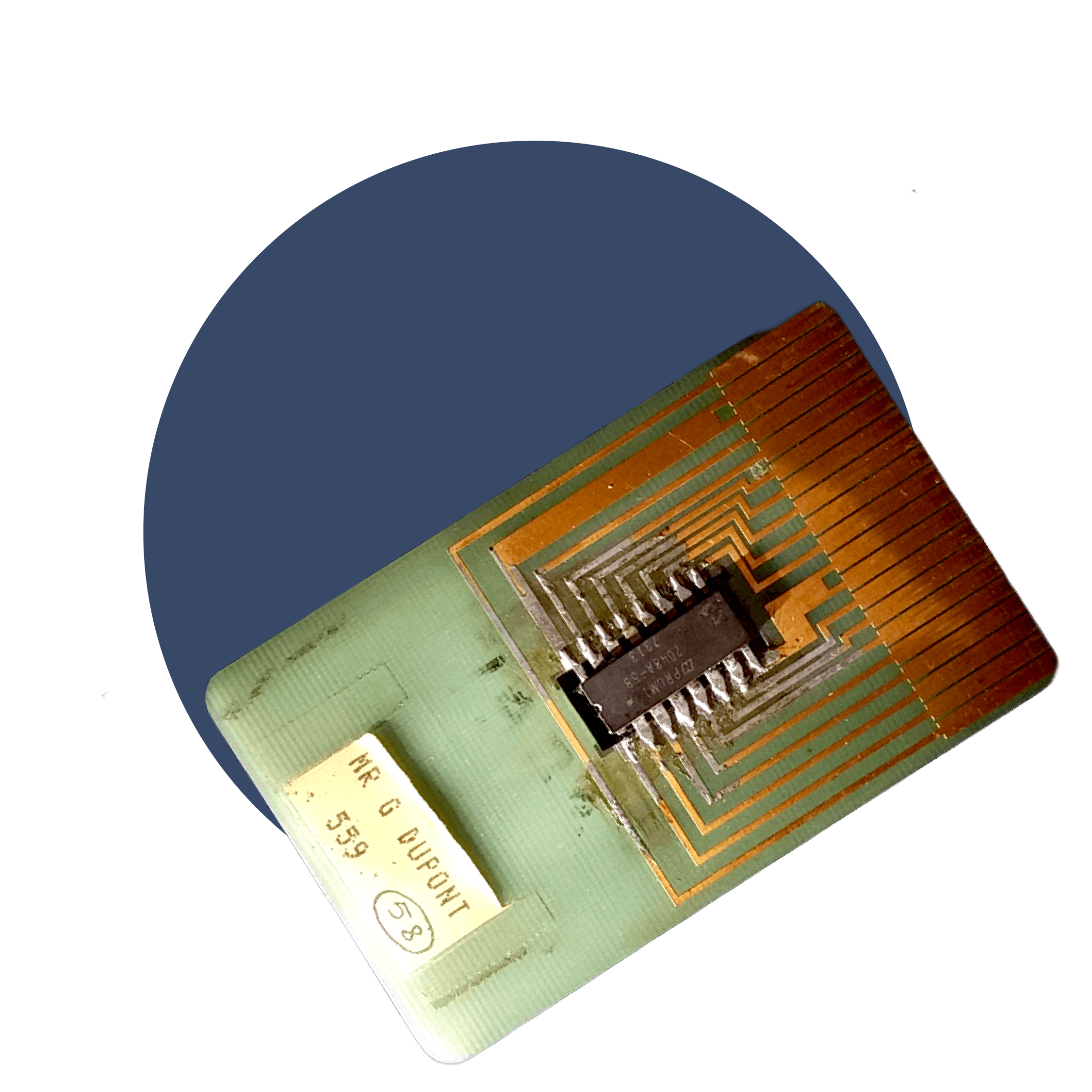

French inventor Roland Moreno created the smart card. It was described in a New York Times profile as a “tiny ubiquitous computer microprocessor embedded in plastic that is now found in bank debit cards, mobile phone SIM cards, transit tickets, passports, and other ID cards.” Pretty neat.

Then in the 1980s, bank cards emerged with these microchips installed. It had a domino effect on credit card culture, bringing a new level of technology and convenience to point-of-sale payments.

Plugging payments into mains.

Plugging payments into mains.

By the mid-1980s, payments were faster, safer and killing far fewer trees. Then the Internet was born, and transactions joined the world wide web.

Information from electronic payment terminals (often called a speed point machine) and a customer’s bank could be connected via a landline connection, also known as a public switched telephone network (PSTN).

Some stores still have these installed. You’ll know when you have to stretch over a counter to punch your pin into a machine fixed in one location, installed to a telephone socket.

Thankfully we’re no longer in the 80s. Today, wireless internet connects to terminals via 3G, 4G, GPRS, WiFi, or Ethernet. No leaning over the counter required.

Tapping into contactless card payments.

At first, the recent introduction of contactless card payments was a convenience. Tapping your card instead of swiping or inserting is faster. It keeps the queue moving.

The lived experience of a global pandemic highlights that contactless payments are about far more than that.

Mobile card machines like ours, and transaction apps like Snapscan and Zapper, are affordable ways for business owners to let their customers pay safely – through 3D Secure and by minimising physical touch.

Gazing into the crystal ball.

What do card payments of the future look like? We think biometrics will have a big role to play. Smartphone users are already familiar with the safety and convenience of fingerprint authorisation. Chips and personalised identity configurations will increase shoppers’ confidence in their security, and speed things up at checkout.

More prolific use of mobile payments is also inevitable. As more people adopt payment links and QR codes, Business Insider expressed that “merchants will need to meet that desire or risk losing their customers to other stores that do.”

Card machines will evolve to accommodate these demands and make life easier for people. Maybe we should invent a card machine that does your taxes as you get paid. Jokes aside, Yoco will continue to innovate in the card machine and mobile payments space.