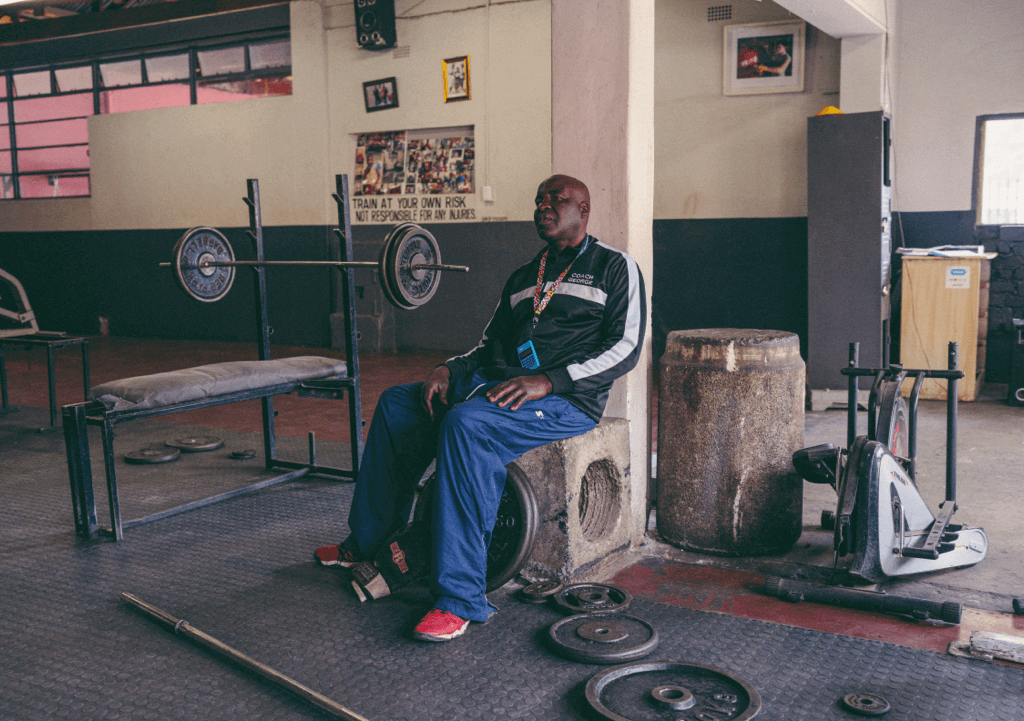

Most entrepreneurs and self-employed people start off as Sole Proprietors, running and operating their business as an individual. However, at some point, it starts making more sense to formally register your business with the Companies and Intellectual Property Commission (CIPC).

But do I really have to? WHEN is this all supposed to happen? Who has the time? And how do I even start? These are just some of the questions we’ll make sure we answer! 🙌

Here’s a quick guide to understanding why, when, and how to register your business.

Understanding the lingo - what do all these terms mean?

Sole Prop vs Partnership

If your business is not currently registered with the CIPC, then you’re operating as either a Sole Proprietor or a Partnership.

A Sole Proprietorship means that your business functions and exists in your own personal capacity, and not as a legal entity. You’re taxed as an individual, with the business profits allocated as your personal income.

A Partnership runs in much the same way, except that there are two or more people running the business, and they all contribute to the business, sharing in the profits and losses. Each partner will be taxed individually on their part of the profits, as their personal income.

Private Company

A company that has been registered with the CIPC is commonly referred to as a Private Company, and usually ends with ‘(Proprietary) Limited’ or ‘(Pty) Ltd’. Once registered, the business is treated by South African law as a separate legal entity, and becomes subject to a wide range of requirements like submitting annual financial reports to the CPIC. The company must also be registered with SARS as a taxpayer (unlike in the case of a Sole Proprietor, who pays tax as an individual).

Clearly, running as a Sole Proprietor or Partnership sounds a lot more hassle-free, and involves fewer administrative costs or hurdles…

So why would you choose to register your business? And when is the right time?

When it makes financial sense

As a Sole Proprietor, you’re entirely responsible for the financial risks involved in running your business. You’re liable for all debts, but more importantly, if the business fails, then all of your assets – even those unrelated to the business (like your house, car, furniture) – can be seized, and assigned to repaying your business creditors. This is a huge personal risk to take on, especially as your company grows. When you register your business as a Private Company, it releases you from being personally liable in a worst case scenario.

Being formally registered also allows you to apply for business loans or investments, take on shareholders, and get access to various funding resources only available to Private Companies – from angel investors, to government funding. (FYI Yoco Capital allows any type of business to get cash funding, fast #justsaying).

When it makes business sense

Registering your business could broaden your client and supplier bases too, because many people prefer dealing with a Private Company that they feel comfortable is legit. Furthermore, when you register your business, it opens you up to pitching for funding from larger corporates or the government.

Like many entrepreneurs, you may have the ultimate vision of selling your business off one day, and retiring to a tropical island. Even if climate change has ruined the tropics by then, you’ll need to build a company that you can sell. You guessed it, it’ll need to be formally registered!

When it's more tax efficient

In South Africa, individuals are taxed on a sliding scale – the more you earn, the more your average tax increases. This applies to individuals earning more than R78 750 per annum.

A registered company, however, is taxed at a flat rate of 28% of profits (as of 2019), and a further 20% when shareholders receive their dividends.

Based on this system, initially, when you’re starting out and generate less income, it makes sense to operate as a Sole Proprietorship. However, as your business grows and your profits increase, you may actually pay less tax by registering as a (Pty) Ltd.

No more business backwards. The Yoco Khumo is a standalone card machine that gets you paid in 3 seconds with free, ultra-fast 4G data.

— Yoco (@Yoco_ZA) October 14, 2021

Get it at the launch price of just R799 once-off.

Flip from old.

Flip from cash. #FlipToKhumo

How to register your business

The CIPC is a government organisation, created to enforce and uphold the Companies Act (2008). Luckily, the new CIPC e-services allows companies with South African directors (that’s you!) to register without having to (stand in a long queue and) physically submit any paperwork – it’s all online! Here’s what you’ll need to do:

Step 1 – Register as a customer with CIPC

Step 2 – Login and register your business

Next, log back into the system and click on ‘Company Registration’, followed by ‘Register a New Company’. You’ll need to follow the prompts and fill in the online forms, asking for all your business details. For a more detailed guide, check this out.

Step 3 – Pay the registration fee

Thankfully, this is also totally online: you’ll get a pop-up notification once your payment is successful. That’s it! You’ve registered your company! In case you get stuck, here are some FAQs to help.

Choosing when to register your business can feel like a “future-me” problem until it stops being funny – you could save thousands on tax, and boost your clientele and supplier networks, all while reducing your own personal liability and risk. These considerations become ever more pressing as your business grows, so don’t put off going legit until it’s hurting you not to.