Battle of the Boom: How Johannesburg Outpaces Cape Town, Driving Festive Spend

We explore the spending rhythms that define the festive season, and what they mean for South Africa’s independent businesses.

20 Feb 2026

Yoco Editor

This is part 3 of our Seasonal Spend Report, where we uncover key spending rhythms that occur during the festive season, and what impact this has had on the South African independent business economy.

Each festive season, South Africa’s economic engine shifts gears and Gauteng is where the first signs of festive spending emerge. Holidaymakers leaving the province also play a major role in driving local tourism booms, especially along the country’s coast.

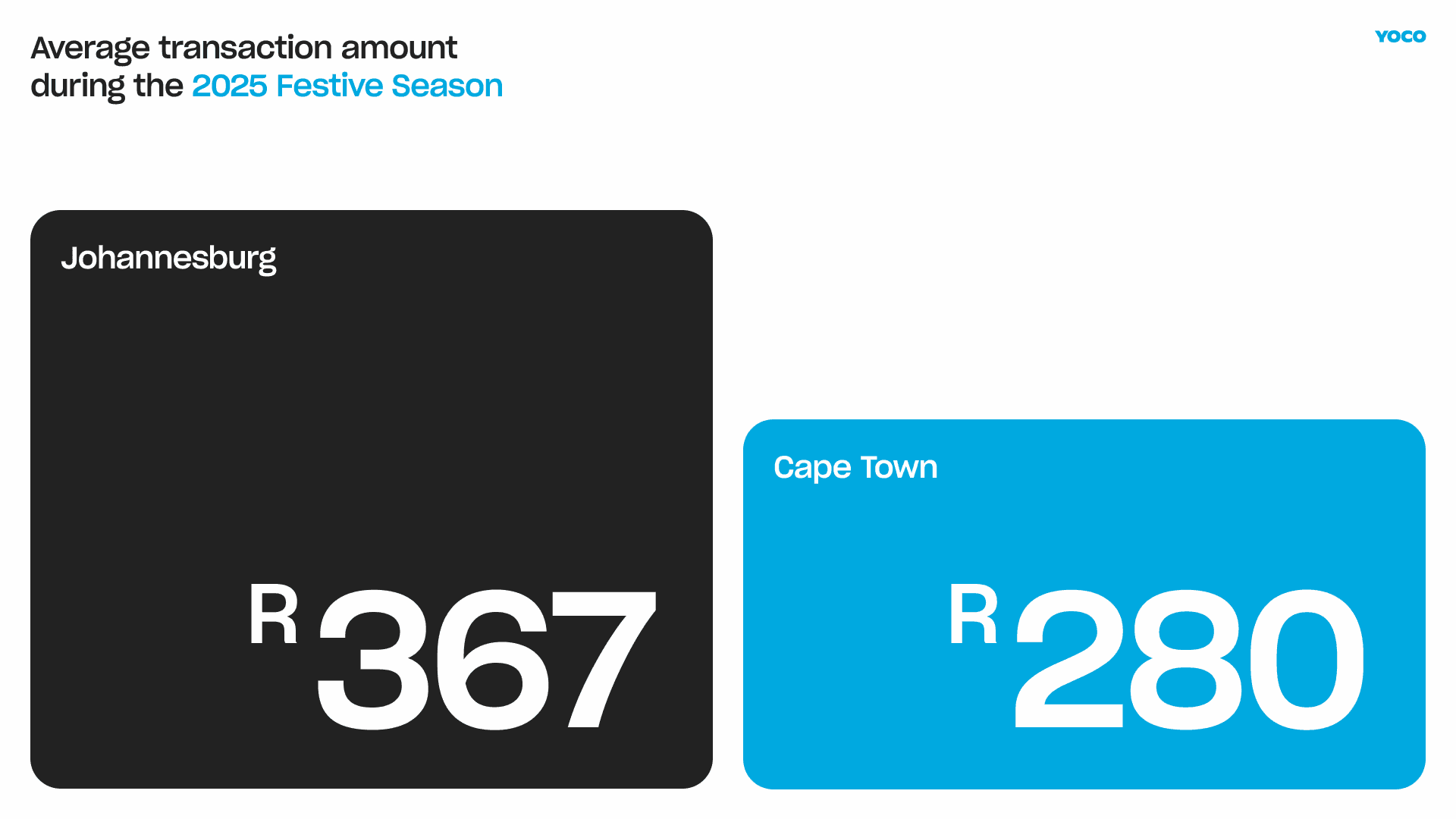

Yet even as people leave, Gauteng remains South Africa’s economic powerhouse. The province records an average transaction value of R311, 17% higher than its pre-festive average and R30 above the Western Cape.

What this tells us is that December isn’t one festive season, but several spending events within this seasonal window. Spending doesn’t peak once and fade neatly around Christmas. It moves in phases: From early retail surges in Johannesburg, to tourism-led food and drink spend along the coast, to last-minute shopping spikes just before Christmas.

Using local, in-person transaction data from over 200,000 Yoco merchants nationwide, this report breaks the festive period into its underlying phases. We begin in Gauteng, where the season starts, and track how spending redistributes as December unfolds across provinces, industries, and cities.

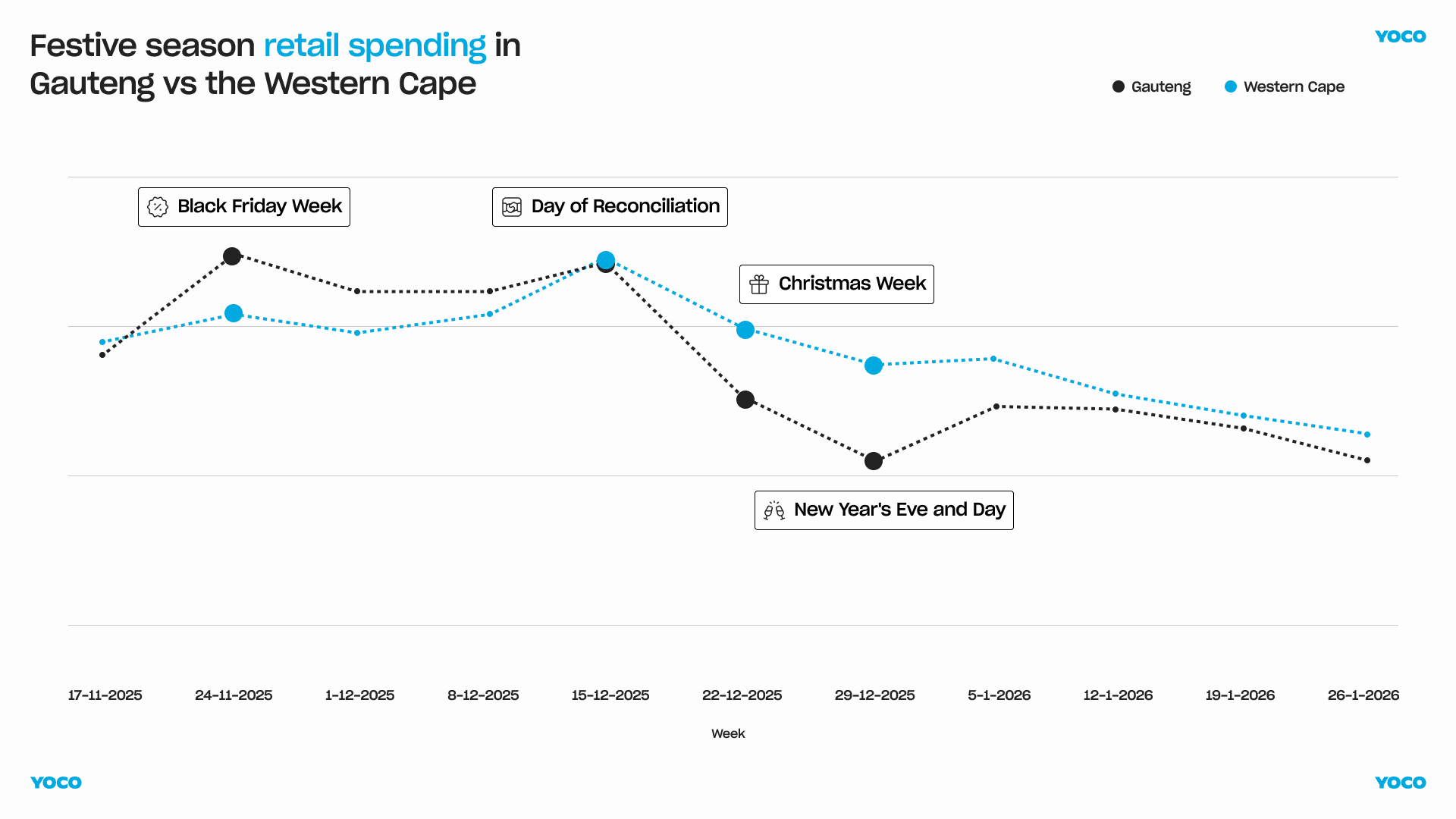

The festive season starts in Gauteng and retail leads the shift

Gauteng’s role as the country’s economic engine is most visible in retail. This is where the festive season begins.

In the province, retail spending increases by nearly 60% between the week preceding Black Friday and into the week itself. This surge marks the first major inflection point in festive spending nationwide, signalling the transition into the peak trading period.

This increase is more than twice as large as in the Western Cape, which is the second-largest region for retail activity.

Retail spending in Gauteng then peaks again just before Christmas. But by this stage, the broader geography of festive spending has begun to shift.

As residents prepare for holidays and travel out of the province, spending begins to redistribute toward coastal regions, where tourism-driven industries take over. We found very interesting data around small towns over this season, which you can read more about in part 2 of our report.

Even after the festive season exodus, Joburg remains South Africa’s spending powerhouse

While Gauteng may experience a festive season exodus, its economic influence remains significant largely due to the spending power of those who stay behind.

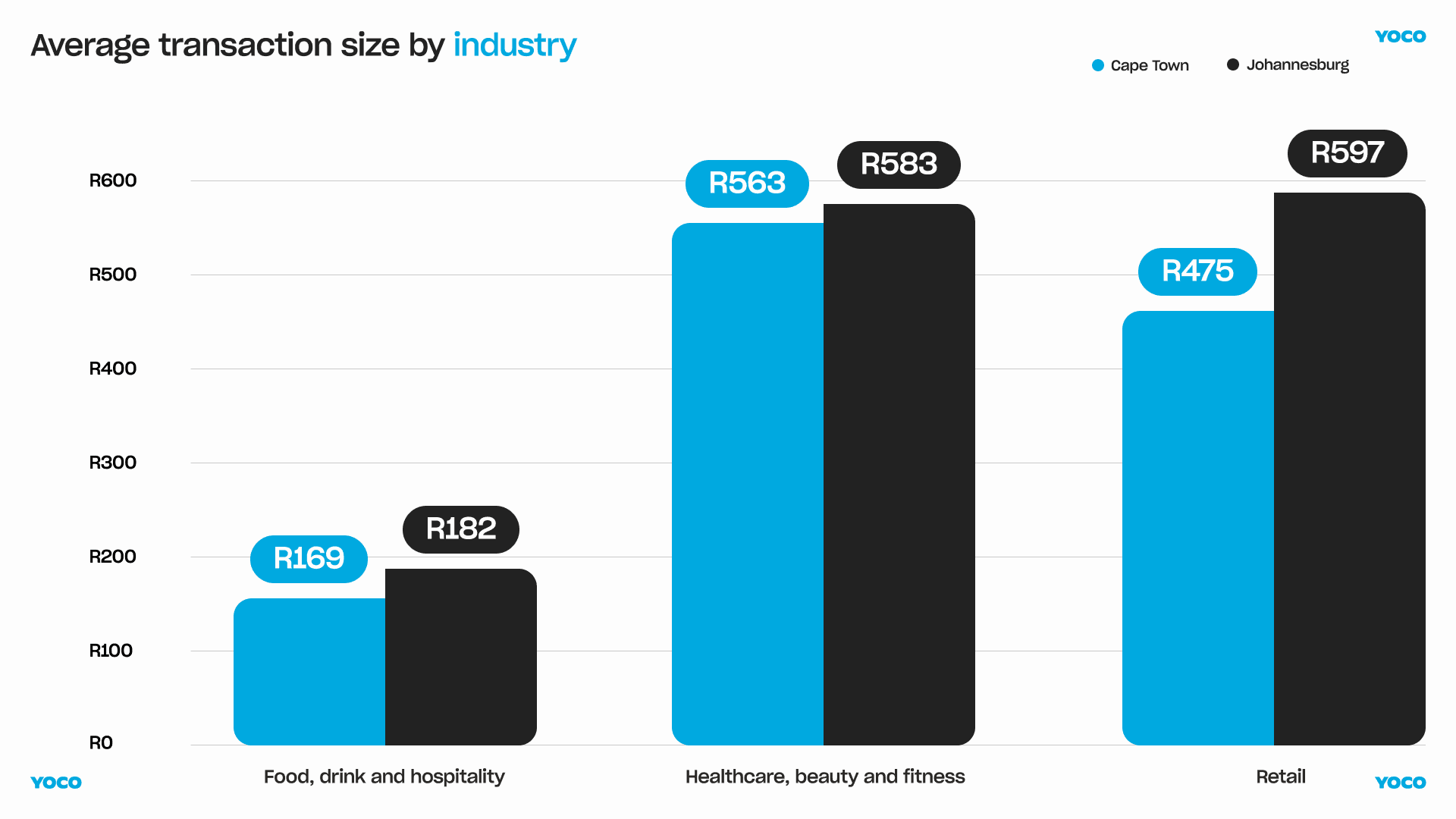

This is particularly evident in Johannesburg. Despite Cape Town’s influx of visitors, Johannesburgers spend 23% more per transaction than Capetonians. This pattern persists across industries.

For food and drink merchants, customers in Johannesburg spend 7% more per transaction, on average, than in Cape Town. In the health, beauty, and fitness sector, a 3% gap separates the cities.

Johannesburg’s greater spending power is also evidenced in the wide gap between retail spending between the two cities. Johannesburg’s average transaction value is more than 20% higher than Cape Town’s.

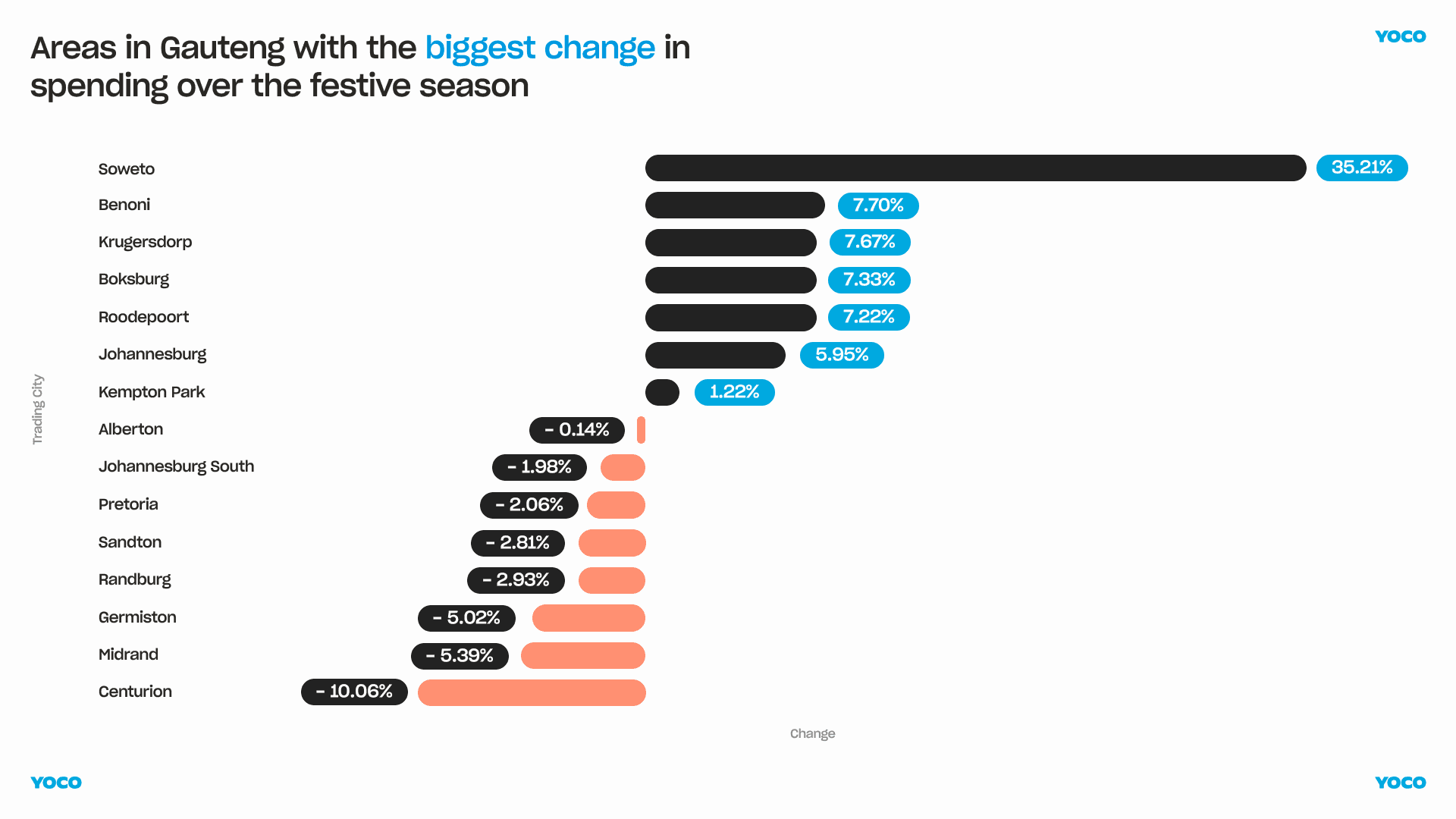

Not everyone leaves: local communities sustain Gauteng’s festive economy

Festive spending patterns also vary significantly within Gauteng. Some areas see spending decline as residents travel, while others experience notable increases that are driven by communities that remain locally active.

Centurion leads the province among areas seeing a decrease in spending over the festive season, with transaction amounts in the city decreasing 10% between November and December. Midrand and Germiston follow with decreases of 5.4% and 5%, respectively.

Sandton, one of the province’s wealthiest areas, also saw a 2.8% decrease as residents travel during this period.

By contrast, some areas see an increase in spending as residents stay behind and choose to spend locally. Across Johannesburg as a whole, spending increased by an average of 6%.

However, Soweto stands out as the single largest contributor to local festive growth with a 35.2% increase in spending during the festive season.

Food and drink spending is Soweto's main driver for festive spending, accounting for nearly 70% of holiday spending. This is more than double the average for Gauteng as a whole.

Festive food and drink spending reflects different provincial roles

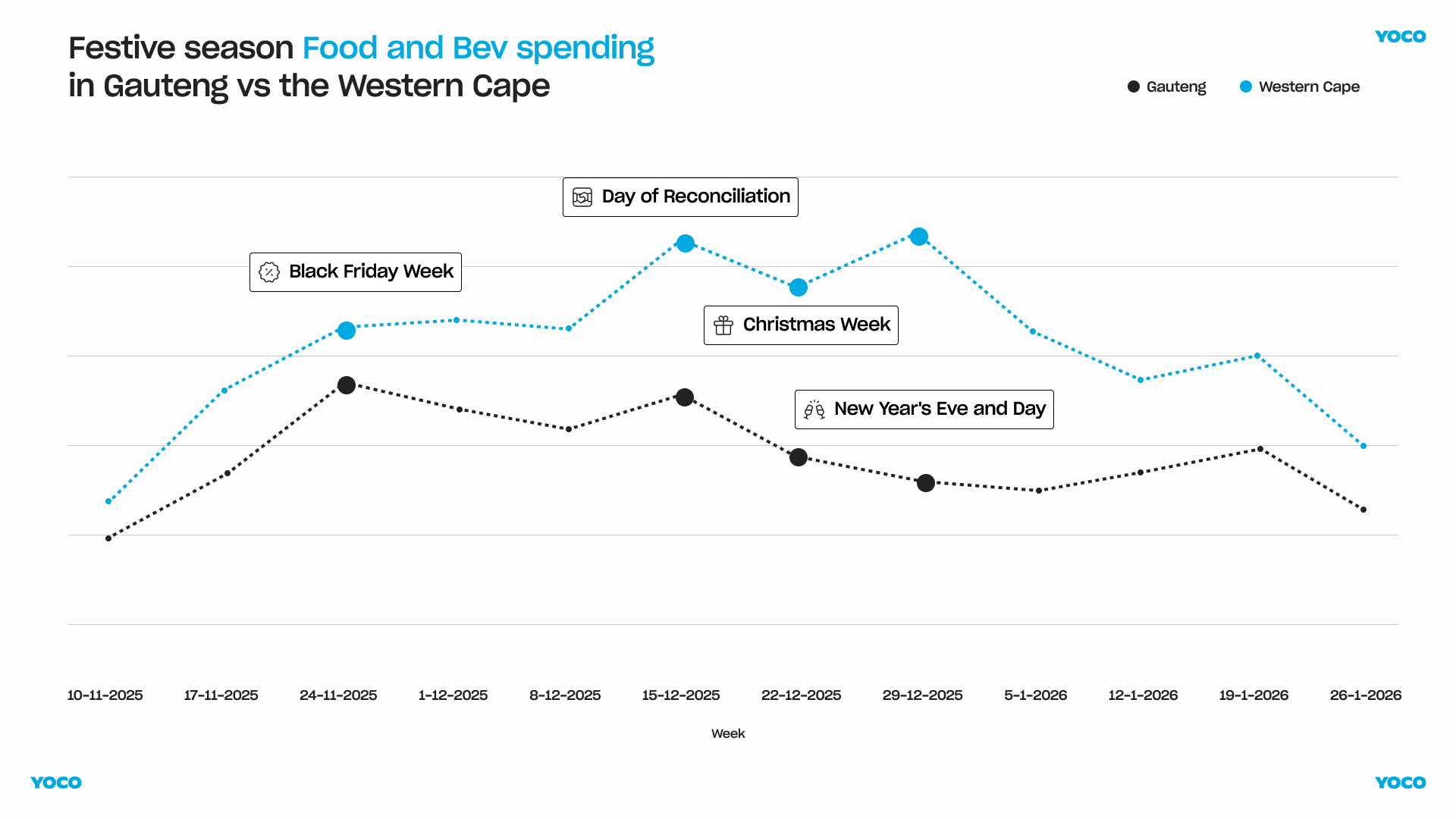

Looking at food and drink spending patterns in particular clearly demonstrates how festive spending differs further between provinces.

In the Western Cape, local food and drink spending increases sharply from late November into early December, as visitors arrive. Local food and drink spending in the province peaks on the 20th of December. This corresponds to the time when domestic tourist numbers are at their highest and before many independent businesses close in the run up to Christmas.

Spending climbs again as the New Year approaches, and declines in the first weeks of January as tourists return home.

Moving to Gauteng, food and drink spending peaks on Black Friday in line with retail patterns, which speaks to preparations for the holiday season.

Following this, food and drink spend in Gauteng sees a decline before peaking again around the Day of Reconciliation. By mid-January, both provinces return to their pre-festive baselines.

Understanding local patterns to unlock additional growth

The festive season is a crucial period for many businesses, but it’s not a single, uniform moment.

From Gauteng’s early retail boost to the Western Cape’s pre-Christmas rush, understanding when and how spending shifts can make the difference between an average season and an exceptional one.

More importantly, recognising the distinct spending phases between Black Friday and Christmas allows merchants to plan with far greater precision. Here are 5 tips to help make the most of the festive season and to set yourself for a saner new year.

Plan for when your customers actually spend not just “December”

Treat the festive season as three planning phases, not one. Mid-November to Black Friday is best for retail spending on gifts and bulk purchases. From early to mid-December, spending shifts to tourism-led food and drink purchases on the coast. After Christmas, we see one last rally in spending as we ring in the new year, where once again we see food and drink perform strongly.Adjust promotions based on local behaviour, not national averages

For businesses in Gauteng, running promotions earlier can help you capitalise on the province’s retail boom. For those in the Western Cape, prioritising late-season offers, especially the week before Christmas, as well as tapping into experience-driven messaging, can unlock a meaningful boost.Match opening hours to peak demand windows

Extend hours during your true peak weeks, not the entire month. Shorten hours when transactions reliably dip (for example, just after Christmas Day). Make sure festive hours are updated on Google, visible on social media, and clearly communicated in-store.Plan ahead for the January slowdown and use it to retain customers

Use the post-festive period strategically by running targeted January promotions or encouraging repeat visits. Actively re-engaging customers during this transition can help stabilise revenue and build momentum for the months ahead.Use Yoco Capital as a tool to maintain stability as you prepare for the next growth cycle

The post-festive slowdown can put pressure on cash flow. Accessing funding during this period can help merchants smooth out short-term gaps, maintain consistent stock levels, and avoid scaling back operations just as customer spending begins to recover. It will be paid back automatically as a percentage of your sales, allowing you more flexible cash flow without having a significant impact on your bottom line.

If you found this interesting and would like to dive even deeper into the numbers, there are two additional issues in our Seasonal Spend Report, on how high-spend international tourism has driven our economic boom, and the impact of local tourism on our economy.

For any press-related queries, contact [email protected]

Need help finding the right product?

Let us help you choose the best fit for your business.